The Role of Artificial Intelligence in Preventing Non-Performing Assets in Banking

Have you ever wondered or asked someone, why do banks become bankrupt if they are the institutions that get the highest deposits of money more than any other industry? Even while adhering to compliance and tons of rules and regulations in lending money, you might wonder why they still have a hard time while recovering money back from the borrowers? As per Federal Reserve Board, there was about $4.225 trillion in total outstanding consumer credit during last February 2020.

Well, banks and loan providers make huge financial profits if everything goes excellent; they receive massive credit deposits, give loans with the highest interest rates, and get hefty mortgages. But if even the smallest thing goes wrong at scale, and two out of ten people fail to repay their debt, it turns on a dime, and banks float on the verge of bankruptcy.

A high collections ratio is necessary to build revenue. And every lending institution knows that! Small boosts in collection will grow long-term profit extensively, and small losses in collection can give BFSI industries a tough time, sometimes beyond what the bank can handle! But you cannot just let the sleeping dogs lie and expect an overnight miracle.

In this blog, we’ll explore the top three reasons why financial institutions are failing in their debt-collection process. Well, the cherry on the top is, we will even give you insights and technology solutions on how to end your debt credit collection woes once and for all!

What are NPAs?

If you either fail to pay or delay the payment of your loan’s principal or interest, the loan is then considered to be in arrears. Again, if the debtor fails to meet his obligations and it is not possible for him/her to repay the amount, the lender considers the agreement as broken, and the loan is then marked to be in default.

Non-performing assets (NPAs) are a classification for loans or advances that are in default or in arrears. In India, for a financial asset to be declared as a non-performing asset or NPA, the borrower or lender must have either the principal or the interest on the loan or advance, overdue or pending for a minimum period of 90 days.

How AI pass for financial institutions can prevent NPAs

An AI pass for financial institutions can prevent non-performing assets (NPAs) in several ways, including analyzing and predicting credit risk, detecting and preventing fraudulent activity, early warning systems, and monitoring and managing existing loans to identify potential risks. By analyzing data from various sources and taking proactive measures with the help of AI, financial institutions can make better-informed lending decisions and lower the risk of NPAs.

Let’s now discover how AI pass for financial institutions can prevent NPAs and help in npas solutions debt collection –

Lack of dynamic and personalised communication with customers

Gone are the days when a one-size-fits-all strategy worked for reminding customers about their payment due dates. Today’s customers are time-poor and occupied with a lot of other things. It’s not fair to expect customers to pick up calls from debt collection agents during busy days and months. However, as a bank, somehow you must remind them, maybe five or six times a day, without giving up hope. Doesn’t sound easy, right?

Even though it is difficult to reach borrowers, persistence is one of the many solutions to getting them to pay on time without generating awkward scenarios of embarrassment. No one wants to become a credit or debt defaulter by choice!

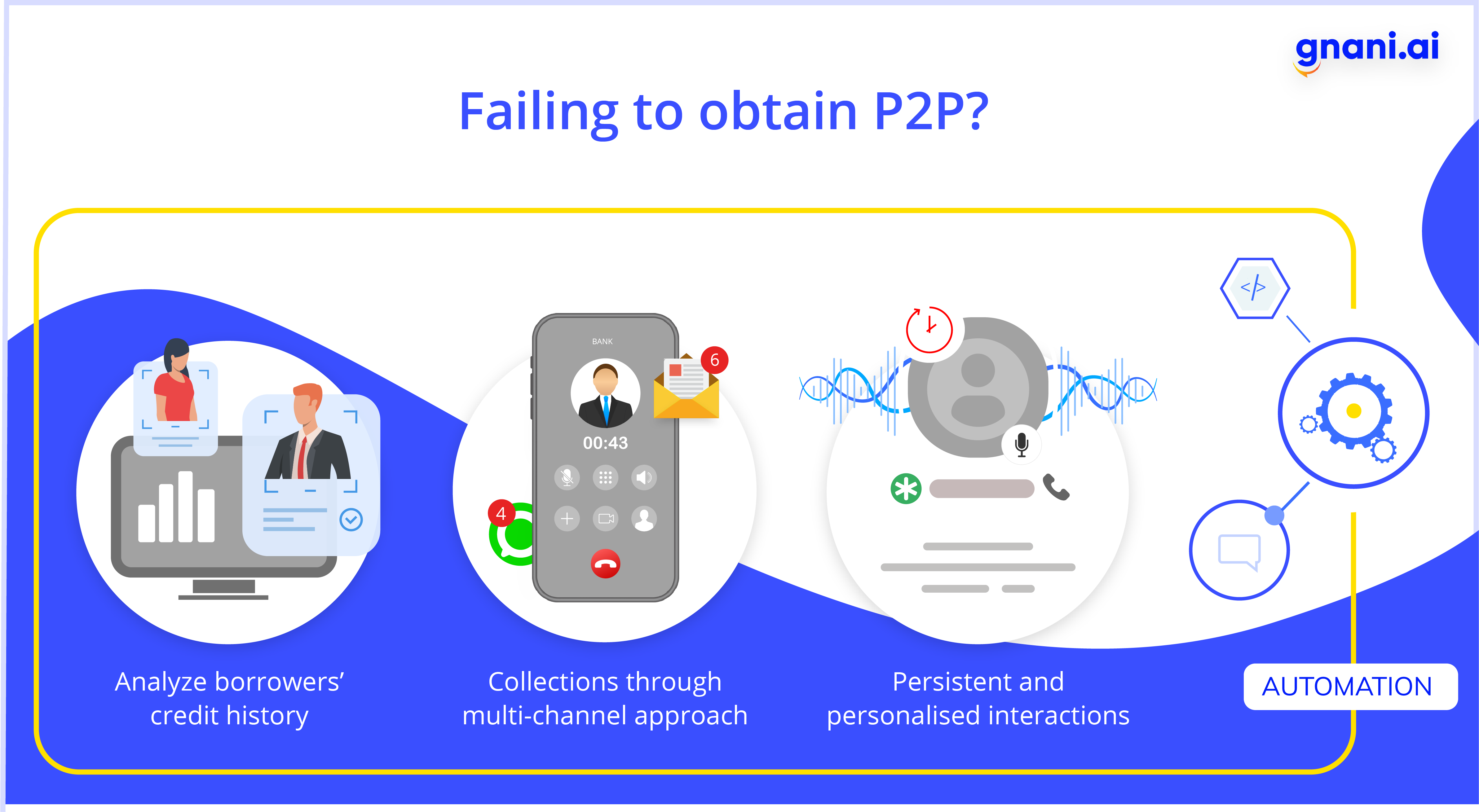

Solutions: With technology automation enabled by conversational AI bots and data, you can persistently reach out to customers, streamline financial payment, automate digital reminder communications without the need of a human agent until necessary!

Slow in assessing profiles that may turn into NPAs and potential defaulters

A debt or a loan’s value is always related to the creditworthiness of an individual or business that opted for a particular sanctioned credit amount. And to determine creditworthiness, lenders must have enough data about the individual, bank or company. Without having insights from customers’ accounts and their online, digital and social activities, it becomes very daunting to detect potential profiles that are going to default debt and at the same time take corrective actions before an individual becomes a credit defaulter or delinquent.

Solutions: Leveraging AI technology such as machine learning (ML) and natural language processing (NLP) by using financial data can help assess and analyse borrowers’ digital footprints and identify their financial situations. For example, if a borrower’s monthly income dips and his digital or social media profile indicates a job loss as a reason, lenders can take the right action at the right time and prevent potential defaults.

Automation eliminates the chances of insolvency

Digital automation increases debt collection efficiency while reducing bad loans and debts. Undeniably, AI-based technologies are not at par with human counterparts when it comes to solutions such as credit collections and financial recoveries. Be it speed or non-intrusive means of communication; conversational AI data technology wins it all! It wouldn’t be wrong to term conversational AI as the technology antidote for banks and loan providers who want to get back delinquent customers into the mainstream.

Along the same vein, conversation AI-powered digital and virtual assistants will witness a considerable adoption in the BFSI sector. In no time, we will see conversational AI being incorporated into their core strategy as solutions to enhance customer experience, increase financial revenue and debt collection, boost collections rate, and save a lot of money that goes into handling delinquent customers. All we need to do is wait and keep an eye out for this booming AI space.

How can Gnani.ai save you millions in NPAs collection debt collection?

In a typical scenario, collection agents would call and contact debtors without collating necessary insights about the borrower. If human agents are involved in the calling process, follow-ups might not get done in a time-efficient way. However, with automation freeing agents’ time and engaging them in other high-value tasks, debt collections can be achieved in a short duration of time. Since the beginning, automation has remained one of the vital focal points of Gnani. Let’s understand how we enable automation with robust AI data technologies.

Gnani.ai worked with a leading loan provider and automated their end-to-end collections process with AI digital and virtual assistants. The goal was to use credit data to improve the collections rate and reduce efforts and costs involved in managing financial delinquency. Within six months of deployment, our conversational AI-based virtual assistant, assist365 turned out to be an agent of change in the client’s contact centre, bringing about some significant benefits such as:

- 80% reduction in debt collection costs

- 93% customer outreach rate with 42% increase in collection rate

A high collection rate is necessary to become a powerful and successful lending institution!

If digital financial automation through AI technology is your goal this year, get in touch with us today!

Frequently Asked Questions

How can AI help prevent NPAs in the banking industry?

AI can analyze a range of data, including financial statements, credit reports, and market trends, to help banks identify and assess the risk of potential NPAs. This can enable banks to make more informed lending decisions and reduce the likelihood of NPAs occurring.

What specific tasks can AI perform to help prevent NPAs?

Some specific tasks that AI can perform to help prevent NPAs include:

- Analyzing and predicting credit risk: AI can use machine learning algorithms to analyze a wide range of data to predict the likelihood of a borrower defaulting on a loan.

- Early Warning: AI can create warning systems that alert banks to potential NPAs before they happen, enabling banks to take corrective action to prevent them from occurring.

- Fraud detection: AI can help banks detect and prevent fraudulent activity, which can help reduce the risk of NPAs.

Are there any potential drawbacks to using AI to prevent NPAs?

One potential disadvantage of using AI to prevent NPAs is that it relies on the accuracy and unbiased nature of the data used to train it. The AI’s predictions and risk assessments may also be flawed if this data is flawed. Additionally, using AI in the lending process may raise questions about transparency and accountability.

Conversational AI In Automating Customer Onboarding – Gnani.ai

[…] banking, but customer preference will change significantly in the future. They will shift towards voice technology to deal with banking and insurance services such as onboarding and KYC, checking account status and balance, uploading docs, making a payment […]